reverse tax calculator formula

How to Calculate Reverse Charge under GST. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax.

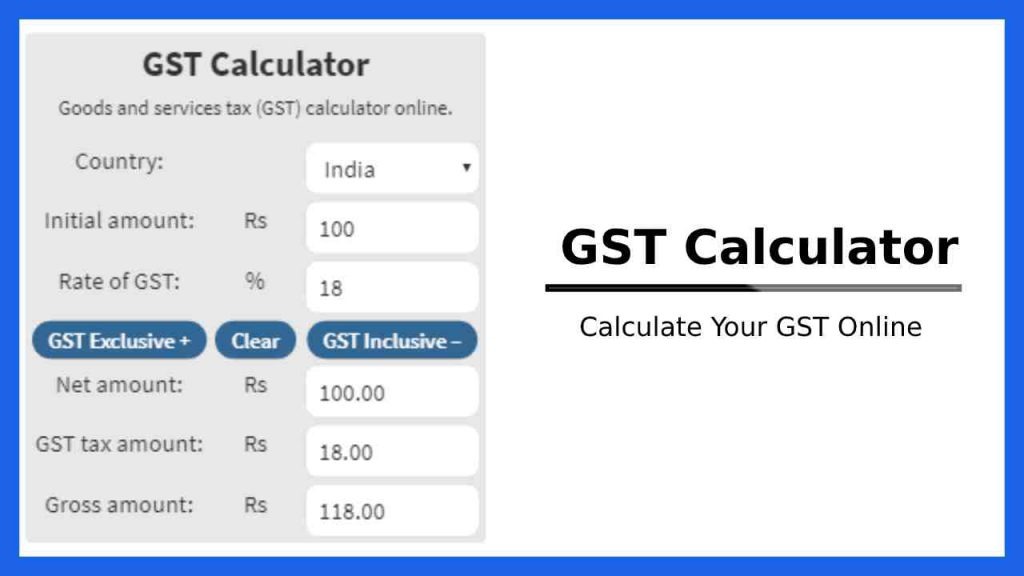

Gst Calculator Calculate Gst Online Gst Calculation Formula

Amount with VAT 1 VAT rate 100 Amount without VAT.

. I appreciate it if you reply on. 6 100 006 6100. And click on the show formula i button to see the formula.

When a price inclusive the tax is mentioned in such cases reverse tax is applied. Formulas to calculate the United Kingdom VAT. For example if a sales tax of 6 percent was added to the bill to make it 212 work out.

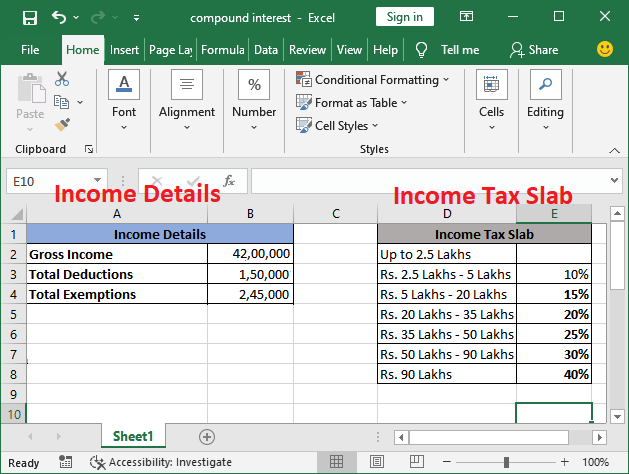

Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. The reverse sale tax will be calculated as following. Net Income - Please enter the amount of Take Home Pay you require.

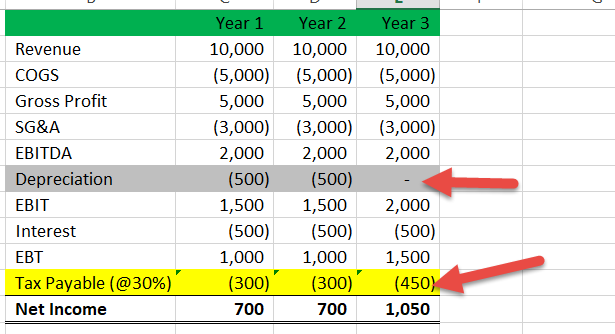

Of course if you happen to live in a state that does not collect sales taxes from the businesses you purchase from then this calculator will not apply to your situation. 06 r6 100sum p5q5 p6 o6p5. Divide the percentage added to the original by 100.

Here is how the total is calculated before sales tax. Collecting Sales Tax Like income tax calculating sales tax often. We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

You will need to input the following. Sale Tax total sale. This is the NET amount after Tax the.

You can use tax rates from 2013 to 2002 and specify. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax. For more percentage calculations click on the show other calculations button above.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Due to rounding of the amount without sales. Tax reverse calculation formula.

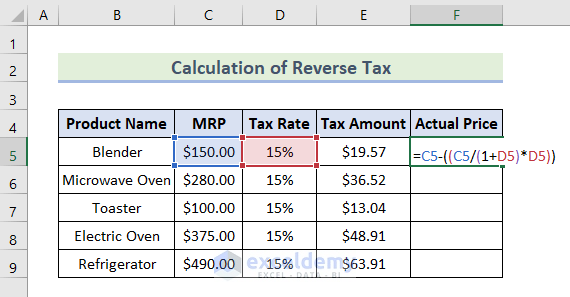

Below mentioned is the formula to use while. Amount without sales tax. Reverse Sales Tax Calculations.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Note that the amount without sales tax of Ontario in this situation should not be rounded before the HST. 100 1 13100 8850 88495575 88495575 x 13100 1150.

Margin of error for HST sales tax. Here is how the total is calculated before VAT. Enter the final price or amount.

This is the after-tax amount. Notice my main language is not English. This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Adding 20 VAT is a straightforward calculation but reverse VAT can be tricky Adding 20 VAT to a price is easy simply multiply by 12 eg. 6 1 0 0 0. You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula.

To add 20 VAT to 10000 simply multiply.

Reverse Calculation Of Tax Using Calculation Type H Sap Blogs

Reverse Calculation Of Tax Using Calculation Type H Sap Blogs

Social Security Benefits Tax Calculator

How To Calculate Sales Tax In Excel

Deferred Tax Liabilities Meaning Example How To Calculate

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

How To Calculate Sales Tax In Excel

Income Tax Formula Excel University

How To Calculate Sales Tax Backwards From Total Reverse Tax Calculator

Sales Tax Calculator Price Before Tax After Tax More

Sales Tax Calculator Reverse Sales Tax Calculator Finmasters

How To Calculate A Reverse Percentage What Is The Formula Quora

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs