what are roll back taxes in sc

They are based on the difference between the tax paid and the tax that. South Carolina General Assembly 123rd Session 2019-2020.

Chatham County Officials Clears Up Confusion On Notice Of Property Tax Increase Wtgs

Out of a 10 acre tract 2 acres are sold.

. It is the responsibility of the purchaser and seller to agree upon whom is responsible for the. When real property valued and assessed as agricultural property is changed to a use other than agricultural it is subject to additional taxes referred to as rollback taxes. Effective January 1 2021 rollback taxes are to be assessed over a three-year period rather than the previous five-year period.

Under prior law rollback taxes were accessed for a five-year period. If you have any questions regarding South Carolina rollback taxes please contact any of the following lawyers or your lawyer at Burr Forman LLP. South Carolina Code Section 12-43-220 was amended in this years shortened legislative session to reduce the.

The Rollback tax is a requirement codified in South Carolina state law. A rollback tax is collected when properties change from agricultural to commercial or residential use. To amend section 12-43-220 as amended code of laws of south carolina 1976 relating to classification of property and assessment ratios for purposes of ad valorem.

2021 brings an update to South Carolina rollback tax laws with. Download This Bill in Microsoft Word format Indicates Matter Stricken Indicates New Matter. Calculation of Rollback taxes For example.

Greenwood SC 29646-2634 Or fax to 864-942-8660 Or email assessorgreenwoodscgov NOTE. The Assessors Office will facilitate the estimate of Roll-Back Taxes that. The start of a new year frequently includes new or updated statutes and South Carolina is no exception.

The difference is multiplied by the millage rate in the appropriate district and that results in the amount of tax due. The market value for these 10 acres is 20000 and the agricultural value is 3120. Rollback Tax Explanation PDF Agricultural Use Application PDF Assessor GIS Property Search.

SC Code of Law Section 12-43-220 4 When real property which is in agricultural use and is being valued assessed and taxed under the provisions of this article is applied to a use other than. Maybank III Member at Nexsen Pruet LLC When agricultural real property is applied to a use other than agricultural it becomes subject to rollback taxes. Purchasers and sellers now will need to.

Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed. An act to amend section 12-43-220 code of laws of south carolina 1976 relating to classification of property and assessment ratios for purposes of ad valorem taxation so as. 2021 Millage Chart PDF How To Estimate Real Estate Taxes.

Chatham County Officials Clears Up Confusion On Notice Of Property Tax Increase Wtgs

Charleston Veggie Guide One Part Plant Style Charleston Vegetarian Eat

Chatham County Officials Clears Up Confusion On Notice Of Property Tax Increase Wtgs

Freightliner Roll Back Tow Trucks For Sale 32 Listings Truckpaper Com Page 1 Of 2

Republicans Pledge Unified Fight To Protect 2017 Trump Tax Cuts Npr

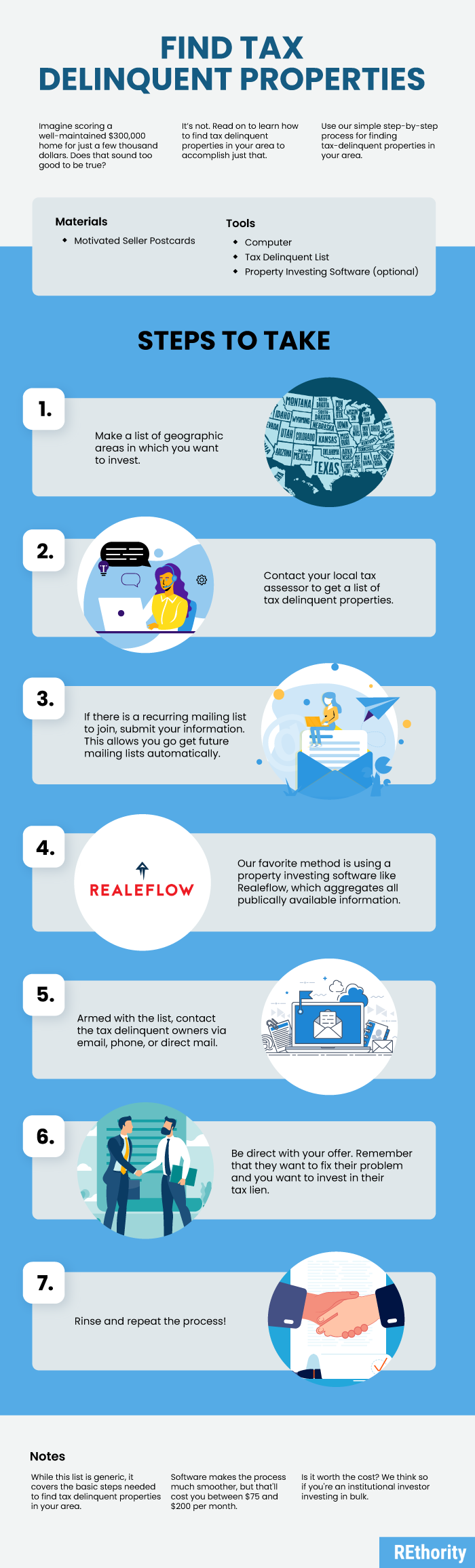

How To Find Tax Delinquent Properties In Your Area Rethority

Chatham County Officials Clears Up Confusion On Notice Of Property Tax Increase Wtgs

Spirits Industry Pushes For States To Lower Taxes On Canned Cocktails

Can Anything Stop Republicans From Rolling Back Rights The Atlantic

Hand Painted Rollable Styling Mat For Wedding Photography Neutral Tau In 2022 Hand Painted Wedding Invitations Place Card Holders

Ci 121 Montana S Big Property Tax Initiative Explained

How To Find Tax Delinquent Properties In Your Area Rethority

Rollable Styling Mat For Wedding Flat Lay Textured Styling Etsy In 2022 Surface Wedding Flats Texture